Every crisis has its prophets. Trump’s April tariffs were no exception: in the past months, many column inches were written about the benefits of selling US shares and buying European shares or defence names like Rheinmetall. A key question now is: how should investors be positioned now that the 90-day tariff pause has ended?

In 2022, when Russia invaded Ukraine, traders piled into oil, gas and mining stocks. And during Covid, any companies that offered ‘remote’ solutions attracted massive inflows. Zoom, Peloton, Deliveroo, you name it.

Momentum is all about catching the next ‘wave’. But over longer time horizons, ‘quality shares’ have been the outstanding asset class.

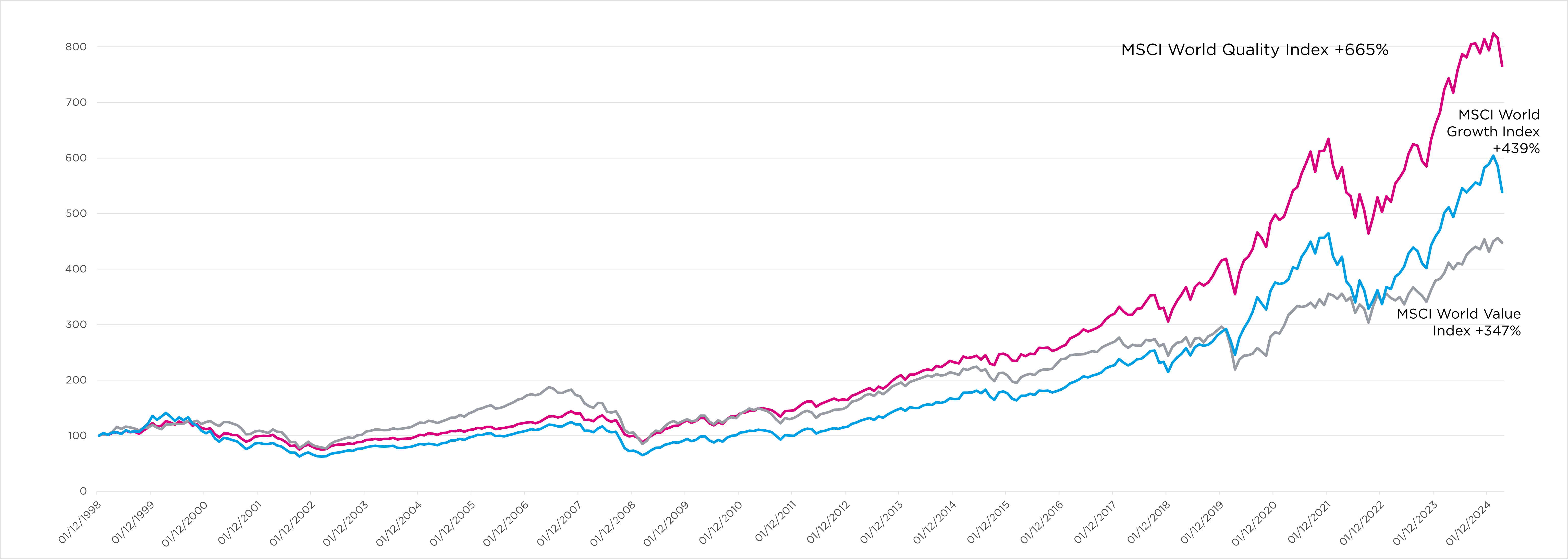

Since their inception, the MSCI World Quality Index has outperformed the MSCI Value Index and the MSCI Growth Index one-and-a-half to two times. And since 2014, quality shares in the MSCI World Index have advanced 12.6% per year. That’s 4.7% per year more than value stocks, 2.6% per year more than the overall market, and even 0.8% per year more than growth stocks. So, even during growth’s ‘golden age’ (2015-2025), quality outperformed.

Figure 1: Growth and value indices significantly lag quality’s outperformance

Source: MSCI. Indices rebased to inception of the MSCI World Value Index and MSCI World Growth Index (1 Dec 1998=100)

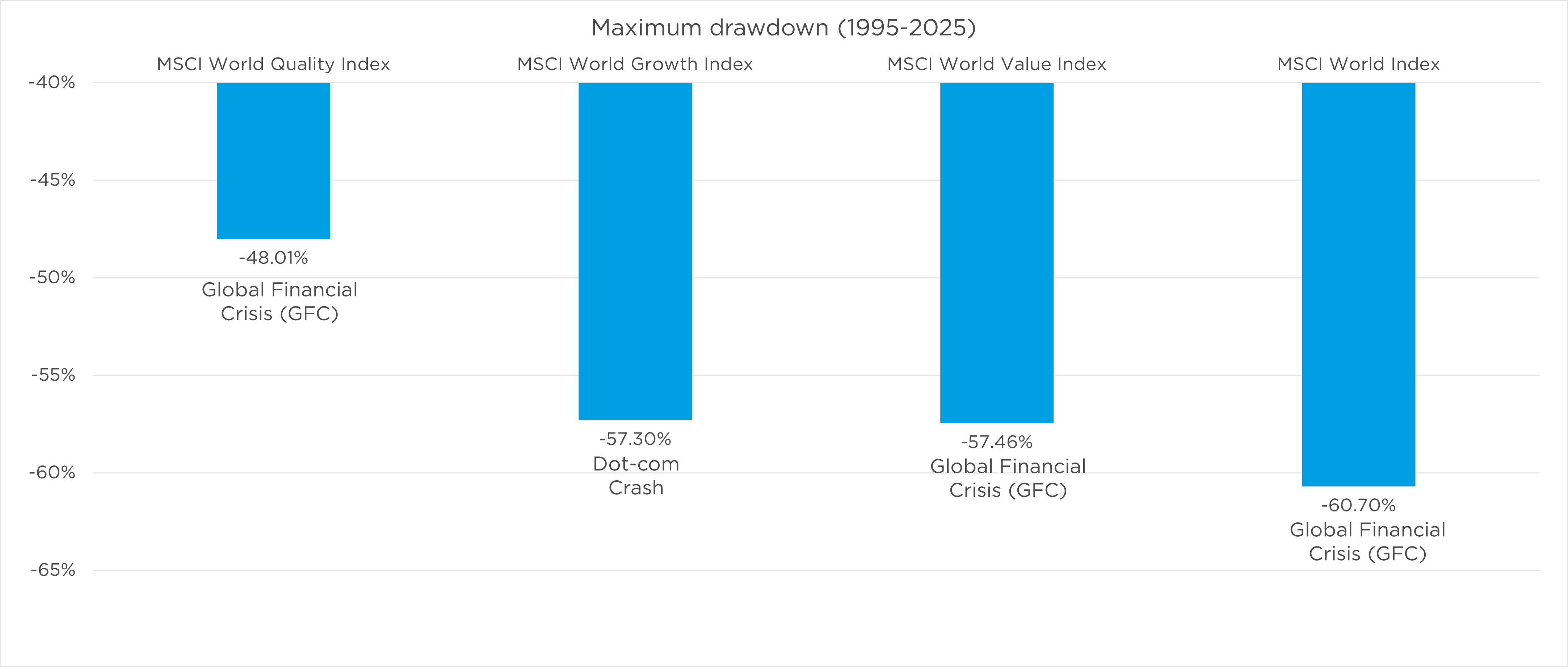

What’s more, quality has historically been a buffer when stock markets plummet.

In the last 30 years, growth stocks had their worst performance during the Dotcom Crash (2000-2002): minus 57% peak to trough. Value stocks, at their worst, fell 60% from their peak during the Global Financial Crisis (GFC) of 2007-2009.

But at their worst, quality share prices ‘only’ ever fell 48%, also during the GFC. Not a great experience, but 10% better than the broader market and a strong foundation for quality’s outperformance in the long run. Playing defence during crises has been as important as catching market rallies.

Figure 2: Quality shares cushion portfolios at times of crisis

Source: CCLA, MSCI

How to pick them

Quality holdings help portfolios deliver long-term results. But what does ‘quality’ look like at the level of individual shares? And how do investors select for quality, bottom-up? In our experience, five characteristics matter.

- ‘Quality’ companies dominate their industries with strong competitive positions. In IT, for example, leading firms like Microsoft, Facebook parent Meta or, in the UK, Sage Group have large customer bases that translate into network effects. This cements their leadership and leads to consistent profitability over many years.

- ‘Quality’ companies have distinct business models. Consistent earnings growth isn’t a coincidence. It’s the result of well thought-out business models that create stability and growth. Quality businesses like Adobe or DocuSign, for example, have low capital intensity, high switching costs and/or recurring revenues, often based on subscription models.

- ‘Quality’ companies more readily turn accounting profits into cash profits or operating cash flow. Firms like Visa or Intuitive Surgical have high margins, solid balance sheets with limited leverage, and persistent cash flow returns on investment (CFROI). Those cash flows compound over time, a powerful force behind their share price appreciation.

- ‘Quality’ companies have multiple sources of growth. In cyclical sectors like industrials, quality companies like Ametek, Siemens, Republic Services or, in the UK, Spirax capitalise on long-term, structural trends, not cyclical ups and downs. In addition, quality companies are better than their competitors at growing their margins. And in sectors where M&A is a viable growth strategy, they’re usually the more sensible consolidators.

- Valuation ratios help identify ‘quality’ stocks. When you invest in quality, you don’t pay the sky-high price-to-earnings (P/E) ratios of growth stocks. But neither should you expect to bag a ‘value’ bargain. Value bargains all too often turn into value traps.

Quality stocks usually trade somewhere between value and growth, at reasonable valuations. US retailer Costco, for example, is a quality stock on our four previous criteria. But at a valuation of c. 60x 2025 earnings, it doesn’t appear on quality investors’ radar screens. By contrast, its peers Home Depot (c. 26x) and TJX (c. 32x) do.

History doesn’t repeat itself … but it rhymes.

We’re no prophets. We can’t be certain what will happen now that President Trump’s 90-day tariff pause ended on 9 July. But in our analysis, April was probably not the last bout of stock market volatility under this president. Statistically, 20% falls in the MSCI World Index occur twice every five years.

Investors shouldn’t try to be prophets, either. Trying to catch the next wave every time a crisis happens isn’t a viable strategy. You simply can’t time the market for momentum, or switch from value to growth at the ‘right’ moment. Instead, for long-term results, reading up on quality investing may be a better use of your time.

Please note: As of 31 March 2025, CCLA and the funds it manages held positions in Microsoft, Ametek, Sage Group, Siemens and Spirax, but did not hold positions in Rheinmetall, Docusign, Republic Services, Meta, or Adobe. Nothing in this document should be construed as investment advice. Past performance is not a reliable indicator of future results.